Ghana stands at a decisive crossroads. After years of macroeconomic instability, escalating inflation, and weakened investor confidence, 2026 is being framed by policymakers as a year of strategic consolidation and disciplined economic reform rather than rapid expansion. At the heart of this shift is the Bank of Ghana (BoG), whose Governor, Dr. Johnson Pandit Asiama, has outlined a bold agenda that prioritises sustainability, institutional strength, monetary discipline, and long-term policy consistency.

This article explores why 2026 is a turning point for Ghana’s economic strategy, what the new focus entails, and how these reforms could reshape Ghana’s macroeconomic trajectory.

Why 2026 Matters: The End of Adjustment, Start of Consolidation

In public remarks at the Bank’s New Year media engagement in Accra, Dr. Johnson Asiama stressed that 2026 will be a transition year — moving from rapid, adjustment-driven policies towards durable frameworks anchored in institutional strength and fiscal discipline.

Rather than reacting to immediate pressures, the BoG’s 2026 strategy emphasises:

- Policy discipline instead of ad hoc interventions

- Strong, predictable monetary and financial systems

- Sustainable, long-term economic outcomes

- Quality over quantity in reforms

This marks a notable departure from earlier phases characterised by aggressive emergency measures to stabilise prices and secure balance-of-payments stability.

From Stability to Sustainable Growth: The New Economic Playbook

1. Entrenching Macroeconomic Stability

After a tumultuous period marked by high inflation and exchange-rate volatility, the Bank of Ghana has succeeded in restoring a degree of economic stability — a foundation that the BoG now aims to make permanent.

Monetary authorities are prioritising:

- Credible, predictable monetary policy

- Effective liquidity management

- Forward-looking policy signals to markets

This means moving beyond crisis management and embedding stability into the economy’s DNA, which is vital to investor confidence and long-term planning.

2. Discipline in Financial Markets and Banking

Ghana’s financial markets and banking sector are set to experience deeper systemic discipline. According to the BoG, priorities include:

- Preventive financial supervision

- Rigorous governance standards in banking

- Sound capital planning and risk detection before systemic problems emerge

These reforms are designed to ensure the financial sector supports sustainable growth without the need for turbulent interventions.

3. Anchoring Policies in Institutions, Not Individuals

A key theme of 2026’s economic strategy is institutionalisation — making policies resilient to leadership changes and political shifts. Dr. Asiama emphasised the need for a shift from personality-driven governance to rules-based, credible systems that ensure long-term stability regardless of political cycles.

Monetary Policy: Discipline, Rates, and Future Outlook

Interest Rate Reductions Reflect Confidence

Ghana’s central bank has presided over a significant easing of monetary policy, reducing the policy rate aggressively through 2025 and into 2026. This trajectory reflects sustained disinflation, improved fiscal discipline, and a return of macroeconomic confidence.

This easing cycle has helped stimulate investment and reduce borrowing costs, setting the stage for broader economic expansion.

Lending Rates Could Fall Below 10% by Year-End

In a clear signal of optimism, the BoG has projected that lending rates in Ghana could fall to around 10% by the end of 2026 — a dramatic turnaround from the double-digit costs of capital that historically stunted business growth and entrepreneurship.

Lower lending rates mean:

- More affordable business loans

- Greater access to capital for SMEs

- Boosted investment and job creation

This is a central plank in the strategy to transform raw economic stability into inclusive economic growth.

Cedi Stability: A Balanced Approach

The Ghanaian cedi’s behaviour in recent years has reflected broader structural challenges. While the currency has shown moments of strengthening, the BoG has emphasised that exchange-rate stability must be balanced and consistent with macroeconomic fundamentals — not artificial or overly anchored.

This nuanced approach is important for maintaining export competitiveness and avoiding distortions that could undermine growth.

Ongoing Reforms: From Gold Reserves to Media Engagement

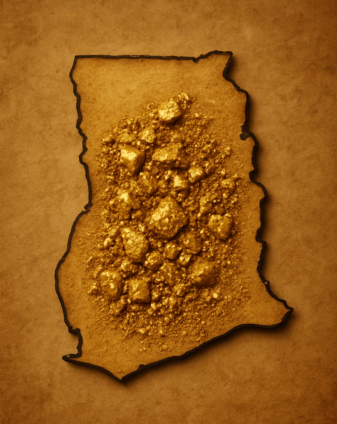

Revising Strategic Programmes like Gold-for-Reserves

One area of ongoing attention is Ghana’s Gold-for-Reserves programme — a scheme designed to bolster reserves in past years. The BoG Governor has urged Parliament and stakeholders to work collaboratively on reforming this initiative, making it more efficient and effective in supporting economic stabilisation.

Strengthening Media Partnerships for Better Economic Awareness

An often-overlooked pillar of Ghana’s economic strategy involves improving how economic news and policy information are communicated. The BoG plans to deepen engagement with journalists and create training programmes aimed at elevating the quality of economic reporting.

This is vital in a digital age where accurate information can shape investor sentiment and public understanding.

The Broader Economic Context: IMF Support and Sector Priorities

Ghana’s economic strategies are not formulated in a vacuum. IMF support has been crucial in backing fiscal consolidation and structural reforms that put the economy on a more stable footing. Progress in meeting benchmarks has led to positive assessments from international partners.

Meanwhile, the government’s broader 2026 economic plan highlights priority sectors such as:

- Agribusiness and agro-processing

- Industrialisation and manufacturing

- Infrastructure and energy expansion

These initiatives are expected to diversify the economy and support value addition across key segments.

What This Means for Ghana’s Future

The BoG’s message is clear: 2026 is not just another year — it’s a turning point. Rather than focusing on short-term fixes, Ghana’s economic strategy is oriented toward building deep, resilient foundations that can withstand global shocks, support investment, and unlock sustainable growth.

Across monetary policy, financial sector reform, institutional strengthening, and communication strategies, the emphasis is on delivering long-lasting dividends for businesses, investors, and ordinary citizens alike.

As the year unfolds, the success of this strategy will hinge on disciplined implementation, continued policy coherence, and strong collaboration between government agencies, the private sector, and international partners.