Latest News

- GroConsult

- No Comments

How GroConsult Powers Compliant, Scalable Talent Solutions for Renewable Energy Projects

Africa stands at a pivotal moment in the global energy transition. With abundant solar, wind, hydro, and geothermal resources, the continent is rapidly expanding its renewable energy footprint — attracting investment, scaling infrastructure, and creating demand for specialized talent. However, this transformation also exposes a key challenge: finding and deploying qualified professionals across borders in a legally compliant way.

This is where the Employer of Record (EOR) model becomes not just advantageous — but essential. Today’s guide explores how EOR companies like GroConsult play a crucial role in green energy recruitment across Africa, unpacking opportunities, challenges, and practical solutions for employers, investors, and workforce planners.

What Is an Employer of Record (EOR)?

An Employer of Record (EOR) is a third-party entity that legally employs workers on behalf of another organization, handling all statutory, legal, and administrative aspects of employment — including payroll, taxes, benefits, and compliance — while the hiring company directs daily operational work.

In essence:

- The EOR becomes the legal employer in-country.

- The client retains control over work assignments and performance.

- The EOR assumes responsibility for employment compliance and operational risk.

This model allows organizations to hire talent in jurisdictions where they don’t have a local legal entity, making it ideal for cross-border workforce expansion.

Why Green Energy Recruitment in Africa Is Unique

Africa’s renewable energy sector is booming. Nations from Ghana to Kenya, South Africa to Egypt are pursuing ambitious renewable energy goals — driving investment into solar arrays, wind farms, grid modernization, and decentralized energy solutions. Yet the pace of growth exposes recruitment challenges that traditional hiring models struggle to solve:

1. Specialized Technical Talent

Green energy projects require highly specialized workers — from solar PV engineers and wind turbine technicians to energy project managers and environmental specialists. In many African countries, this niche talent is still growing. Finding and retaining experts often requires cross-border mobility and international talent sourcing.

2. Geographic Dispersion

Renewable energy sites are often in remote locations — rural deserts, coastal plains, or national parks — far from urban labor pools. This compels employers to recruit from distant cities or even other countries.

3. Dynamic Regulatory Environments

Each African country has distinct labor laws, tax codes, and compliance frameworks. Understanding these variations — and staying updated as regulations evolve — is a real hurdle for international employers.

4. Supply and Demand Imbalance

While the drive toward net zero accelerates demand for green energy professionals, supply remains constrained. Employers must use innovative talent strategies to compete — and that’s where the EOR model offers a distinct advantage.

The EOR Advantage in Green Energy Recruitment

1. Compliance With Local Employment Laws

Different African jurisdictions have their own regulatory frameworks governing employment contracts, employee benefits, statutory contributions, tax withholdings, and termination procedures. Missteps can expose a company to fines, legal penalties, or reputational damage.

An EOR like GroConsult ensures full compliance by:

- Drafting employment contracts that meet local legal standards.

- Administering statutory payroll taxes and social contributions.

- Adhering to mandatory labor protections and reporting requirements.

- Keeping updated on labor law changes across multiple African markets.

This level of compliance is especially critical in sectors like green energy where projects often span multiple jurisdictions — and any legal oversight could disrupt operations.

2. Rapid Market Entry & Speed to Hire

Setting up a local subsidiary or legal entity in a new country can take months, often delaying project timelines. With renewable energy projects, timing is critical — delays cost money and create strategic disadvantage.

By partnering with an EOR:

- Businesses can hire local or international specialists within days or weeks.

- Deployment timelines are compressed — critical for project bidding, installation, and commissioning.

- Hiring becomes possible without the burden of entity registration, permits, and legal approvals.

In the green energy sector, where project windows are tight and competition is global, this speed is a competitive edge.

3. Streamlined Payroll & Workforce Administration

Managing payroll across countries — each with different currencies, tax structures, and social insurance systems — is complex and resource-intensive. For example:

- In Ghana, employers must manage contributions to the Social Security and National Insurance Trust (SSNIT).

- In Kenya, employers must deduct contributions for the National Hospital Insurance Fund (NHIF) and National Social Security Fund (NSSF).

- In South Africa, various payroll taxes, UIF (Unemployment Insurance Fund), and statutory benefits must be correctly handled.

GroConsult’s EOR model centralizes these functions so that:

- All payroll cycles are accurate and compliant.

- Local statutory deductions and benefits are handled automatically.

- Cross-border currency payments are managed with minimized tax risk and FX exposure.

This not only reduces administrative burden but also fortifies employer credibility with local workers.

4. Access to Local and Global Talent Pools

Green energy is a global industry. Employers often need both international experts and highly skilled local professionals. An effective EOR model gives companies access to:

- Local talent networks and recruitment channels.

- Cross-border sourcing for niche skill sets.

- Scalable workforce strategies that align with project life cycles.

By bridging the gap between local hiring ecosystems and international labor markets, EORs help employers attract and retain the talent needed for long-term success.

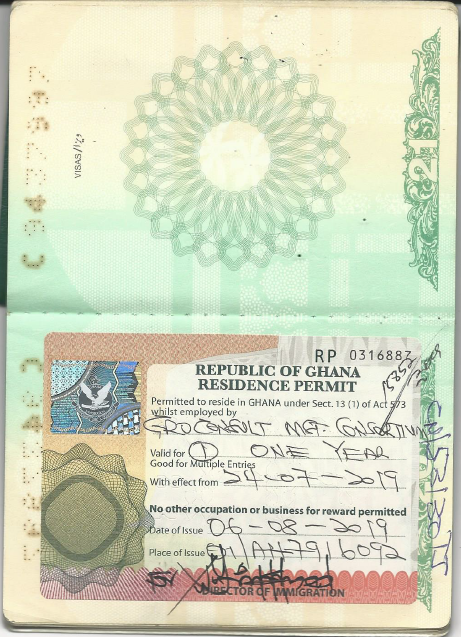

5. Mobility Support for Expat & Cross-Border Teams

Many green energy projects require international experts — especially in areas like high-voltage grid integration, offshore wind design, or advanced solar engineering. However, cross-border workforce mobility in Africa often involves:

- Visa and work permit approvals.

- Relocation logistics.

- Cultural integration considerations.

EOR partners can manage immigration support, documentation, and relocation assistance — enabling companies to deploy talent legally and efficiently across borders.

6. Risk Mitigation & Regulatory Adaptability

Africa’s political and regulatory landscape can shift rapidly — new labor regulations, evolving tax laws, or changes to work permit policies can emerge with limited notice. An EOR’s deep local expertise provides:

- Real-time regulatory monitoring.

- Early warning systems for compliance changes.

- Strategies to maintain business continuity when laws shift.

This proactive risk management ensures that green energy operations remain uninterrupted even in volatile regulatory environments.

The African Green Energy Landscape: Growth & Workforce Demand

Africa’s energy transition is both a challenge and an opportunity. Governments and private investors are expanding renewable initiatives at an unprecedented pace — including:

- Utility-scale solar farms in North and East Africa.

- Wind corridors in South Africa, Morocco, and Kenya.

- Off-grid solar and mini-grid solutions in rural areas.

- Hydro and geothermal investments in East Africa.

These investments are stimulating demand for diverse roles:

| Role | Responsibilities |

|---|---|

| Solar PV Engineers | Design and oversee solar installations |

| Wind Turbine Technicians | Maintain and repair wind turbines |

| Project Managers | Manage project execution and stakeholder communication |

| Renewable Energy Analysts | Forecast and optimize energy output |

| Environmental Compliance Officers | Ensure sustainability and regulatory adherence |

However, hiring for these roles involves navigating complex, region-specific employment landscapes, making EOR support an invaluable strategic advantage.

GroConsult’s Differentiated EOR Approach

At GroConsult, we take the EOR model beyond compliance — turning it into a strategic growth engine for green energy employers.

1. Compliance-First Strategy

GroConsult’s employment framework is built on rigorous legal expertise in African labor laws, tax regimes, and payroll systems. We monitor legislative changes, adjust employment policies proactively, and ensure all statutory obligations are met.

2. Talent Network Integration

We connect employers with high-quality professionals — local and international — through curated recruitment strategies that align with green energy requirements.

3. Full Lifecycle Workforce Support

From onboarding and payroll to benefits and offboarding, GroConsult manages the full employee lifecycle with accuracy and cultural nuance.

4. Mobility & Immigration Facilitation

We provide end-to-end support for visa processing, work permits, and cross-border relocations — ensuring talent mobility is compliant and seamless.

5. Strategic Data & Reporting

Our clients access real-time workforce analytics, compliance reporting, and strategic insights that empower smarter hiring decisions and workforce planning.

Key Benefits for Green Energy Employers

| Benefit | Impact |

|---|---|

| Faster Hiring | Reduce time-to-hire from months to weeks |

| Legal Compliance | Avoid fines and reputational risk |

| Payroll Accuracy | Ensure timely, compliant salary processing |

| Talent Access | Tap into local and global expert networks |

| Risk Mitigation | Stay agile amid regulatory change |

Case Scenarios: How EOR Transforms Green Energy Recruitment

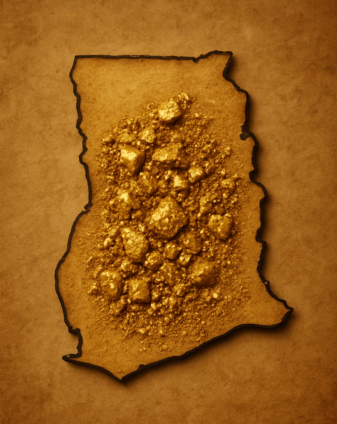

Solar Project in Ghana

A European solar developer needed to staff a 50 MW solar farm in Ghana. By partnering with GroConsult:

- Local engineers and technicians were hired in weeks.

- Payroll and statutory requirements (SSNIT, tax withholdings) were managed compliantly.

- Cross-border specialists were onboarded with appropriate work permits.

Result: Project executed ahead of schedule, with local workforce integration optimized for long-term operations.

Empowering Africa’s Green Energy Future

The global energy transition presents a transformative opportunity for Africa — creating jobs, attracting investment, and driving sustainable development. However, realizing this potential requires innovative workforce solutions that conquer legal, logistical, and cultural barriers.

Employer of Record services — especially when delivered by a thoughtful, compliance-focused partner like GroConsult — empower green energy employers to:

- Hire quickly and compliantly.

- Access diverse and high-quality talent.

- Mitigate risk and operational complexity.

- Expand across multiple African markets with confidence.

Ultimately, GroConsult’s model doesn’t just support recruitment — it accelerates Africa’s journey toward a more sustainable, resilient energy future.

Share This:

- GroConsult

- No Comments

How regulatory clarity and compliance create competitive advantage for global employers and investors — and how GroConsult helps businesses navigate Ghana’s financial system.

Ghana’s financial regulatory ecosystem is anchored around the Bank of Ghana (BoG) — the nation’s central bank and financial sector regulator. For international businesses seeking to enter Ghana via Employer of Record (EOR) arrangements, joint ventures, or direct investments, a deep understanding of BoG’s frameworks, policies, and compliance requirements is a strategic necessity. This article unpacks key aspects of BoG’s mandate, regulatory functions, risk environments, and compliance obligations — and shows how GroConsult uniquely supports clients as a trusted compliance and business expansion partner.

1. Who Is the Bank of Ghana? — The Heart of Financial Regulation

The Bank of Ghana (BoG) serves as Ghana’s central bank and primary regulator of financial systems, tasked with maintaining monetary stability, supervising financial institutions, and ensuring systemic resilience. Its functions are wide-ranging and foundational to doing business in Ghana’s financial sector.

Core Functions Include:

- Formulating and implementing monetary policy to achieve price stability and support economic growth.

- Regulating and supervising banks and non-bank financial institutions to ensure sound financial practices.

- Licensing and oversight of financial institutions, including banks, rural/community banks, microfinance institutions, forex bureaus, and virtual asset service providers.

- Promoting financial stability and payment systems efficiency.

- Issuing and managing currency and acting as the Government’s banker and financial adviser.

For foreign employers, investors, and partners, recognition of BoG’s authoritative role is the first step in ensuring that any entry strategy — whether payroll outsourcing, incorporation, or investment — aligns with national financial standards and international best practices.

2. BoG’s Regulatory & Supervisory Mandate: What It Means for EOR and Compliance

The regulatory framework of Ghana’s financial system is robust, built on statutory instruments and international standards aimed at risk mitigation, consumer protection, and systemic integrity. The Bank of Ghana’s supervisory authority spans the entirety of Ghana’s banking and non-bank financial sectors.

Key Regulatory Laws Include:

- Bank of Ghana Act, 2002 (Act 612)

- Bank of Ghana (Amendment) Act, 2016 (Act 918)

- Banks & Specialised Deposit-Taking Institutions Act, 2016 (Act 930)

- Non-Bank Financial Institutions Act, 2008 (Act 774)

- Companies Act, 2019 (Act 992)

- Payment Systems and Services Act, 2019 (Act 987)

These laws define the legal foundation for licensing, operational standards, compliance requirements, remedial actions, and supervisory powers.

Why This Matters:

Business Credentials

Local compliance with BoG regulations is mandatory for financial operations, corporate accounts, currency transactions, and cross-border money movements.

Employer of Record Validity

EOR providers like GroConsult structurally aligned employment contracts, payroll, statutory deductions, and remittances with Ghanaian regulations, particularly when funds flow through licensed financial institutions.

Licensing & Ongoing Compliance

Engagements involving financial services, fintech, digital assets, and cross-border payroll require precise interpretation of BoG’s licensing criteria, reporting requirements, and supervisory expectations.

3. Financial Stability & Risk Management — Regulatory Safeguards Every Business Must Know

BoG’s regulatory activities extend into risk management — vital for protecting investors, depositors, and the broader economy. This is particularly relevant for foreign businesses handling payroll remittances or opening local bank accounts.

Enforcement & Consumer Protection

The Investigation and Consumer Reporting Office (ICRO) serves as a watchdog within the BoG, handling complaints, fraud investigations, and consumer education.

Why This Matters:

- ICRO ensures fair treatment and fraud prevention within Ghana’s financial sector.

- Companies engaging in payroll services must align with Ghana’s ethical standards and customer protection obligations.

- Effective risk management is non-negotiable for international operations and reflects positively on compliance reputation.

4. Anti-Money Laundering & Know-Your-Customer (KYC) Requirements

International businesses operating in Ghana must satisfy stringent KYC and Anti-Money Laundering (AML) provisions — core components of BoG’s compliance regime.

Know Your Customer (KYC) Policy

BoG’s KYC framework mandates comprehensive customer due diligence for banks and financial institutions, grounded in international Basel standards.

Key Requirements:

- Identification and verification of clients’ identities.

- Ongoing monitoring of accounts and transactions for suspicious activities.

- Policies to prevent criminal elements from using financial platforms.

Business Impact:

Employers must validate employee identity and compliance documents before processing payroll.

Remittance tracking — required for cross-border salary transfers — falls under AML/CFT guidelines monitored by the BoG.

Compliance with AML/CFT standards is essential for maintaining banking relationships and avoiding regulatory penalties.

GroConsult’s compliance services include end-to-end KYC support — from employee onboarding to real-time regulatory reporting — ensuring your Ghana operations stay audit-ready.

5. BoG’s Role in Payments & Remittances — A Critical Pillar for EOR Solutions

The Ghanaian regulatory framework under the Payment Systems and Services Act, 2019 (Act 987) sets out licensing and compliance requirements for payment service providers, e-money issuers, and transaction platforms.

Why This Matters for Employers:

- Payroll and salary disbursements often rely on licensed banking and payment service partners.

- Ensuring that your local bank or fintech partner complies with Act 987 shields your business from operational disruption.

- BoG audits of remittance channels ensure compliance with Foreign Exchange and AML guidelines.

GroConsult partners exclusively with licenced financial institutions and payment partners, giving businesses confidence that salary remittances and statutory contributions are compliant and secure.

6. The Emerging Virtual Assets Regulatory Environment

Ghana is at the forefront of regulating virtual assets and cryptocurrencies through a collaborative framework between the Bank of Ghana, the Securities and Exchange Commission (SEC), and the Financial Intelligence Centre (FIC).

Virtual Asset Service Providers Act, 2025 (Act 1154)

This new law introduces clear registration, licensing, compliance, and reporting requirements for entities dealing in virtual assets — including stablecoins, blockchain-based payment systems, and distributed-ledger technology platforms.

Implications for Business Expansion:

🔹 Employers considering compensation in digital assets must understand regulatory classification, reporting requirements, and operational standards.

🔹 Cross-border companies using virtual protocols must align with Ghana’s policies on cybersecurity, AML/CFT, and prudential safeguards.

GroConsult’s compliance strategy includes guidance on digital asset compliance — bridging emerging technology regulations with practical business solutions.

7. Financial Inclusion, Digital Finance & the Future of Ghana’s Financial Sector

The Bank of Ghana is actively advancing digital finance regulations to foster financial inclusion, support SMEs, and integrate innovative services like open banking and fintech payments.

Highlights include:

Regulatory frameworks for digital banking, digital credit, and fintech services.

Development of supervisory intelligence platforms to monitor digital financial activities.

Pilot initiatives for digital currencies, such as the e-Cedi.

Why It Matters for Employers:

- Digital finance regulations influence employee payroll delivery, expenses reimbursement, and mobile-based salary solutions.

- A forward-looking EOR partner should anticipate changes in digital payments and fintech governance.

GroConsult helps clients stay ahead of digital finance trends — aligning payroll protocols with upcoming regulatory expectations.

8. Corporate Governance & Board Oversight Principles

BoG’s governance structure is headed by a Board of Directors responsible for policy oversight and ensuring compliance with internal and statutory standards.

Board Responsibilities:

- Establishing corporate governance policies.

- Supervising audit, risk management, and compliance protocols.

Implications for Business Expansion:

Multinational investors and employers must adopt similarly robust governance — shaping internal controls, audit mechanisms, and risk frameworks that are in harmony with Ghanaian best practice.

GroConsult provides policy advisory services designed to align client governance frameworks with local regulatory expectations.

9. Compliance Best Practices for EOR & Business Expansion in Ghana

From the regulatory insights above, here are the core compliance pillars any international employer or investor should adopt:

🔹 Regulatory Alignment

Ensure business operations — including payroll, immigration, and banking — comply with BoG statutes, the Companies Act, and AML/CFT obligations.

🔹 Licensed Financial Partnerships

Work only with licensed banks, payment service providers, and fintech entities.

🔹 Robust KYC & AML Protocols

Implement stringent identity verification and transaction monitoring aligned with Basel standards.

🔹 Ongoing Reporting & Audit Readiness

Maintain accurate books, regulatory reporting schedules, and audit trails — essential for remittance oversight and compliance.

🔹 Digital Payment Strategy

Adapt payroll and finance operations to Ghana’s evolving digital payment and fintech ecosystems.

10. How GroConsult Enables Compliance & Growth

As an Employer of Record and compliance partner, GroConsult offers comprehensive services that bridge regulatory requirements with practical business execution:

EOR & Compliance Services

- Employment Contract Management aligned with local labor laws.

- Payroll Processing that adheres to tax and statutory remittance schedules.

- KYC & Due Diligence Support for employees and contractors.

- Banking Liaison Services to facilitate payroll and capital transactions with BoG-regulated partners.

- Regulatory Monitoring & Advisory — so your business stays ahead of compliance changes.

By combining regulatory expertise with operational excellence, GroConsult empowers organizations to launch, scale, and sustain their operations in Ghana’s dynamic financial environment.

11. Final Thoughts

Understanding Ghana’s regulatory framework — particularly the central role of the Bank of Ghana — is essential for businesses that wish to expand responsibly and compliantly. Whether you are considering establishing a local entity, onboarding remote teams, or partnering with local financial institutions, compliance is the backbone of sustainable growth.

At GroConsult, we don’t just ensure compliance — we turn regulatory clarity into competitive advantage.

Share This:

- GroConsult

- No Comments

Africa’s green economy is transforming into a global investment hotspot. In 2025, private investments in clean energy surged, with funding jumping from $17 billion in 2019 to nearly $40 billion in 2024. African startups raised $2.8 billion by August 2025, matching the entire previous year. Key sectors include renewable energy, minerals for green tech, and off-grid solutions. However, challenges like high capital costs, limited global energy investment (just 3%), and financial risks persist. Solutions like blended finance, green bonds, and public-private partnerships are helping attract more investors. Major projects, such as Mozambique’s hydroelectric plant and Zimbabwe’s lithium processing, highlight the continent’s potential to reshape global energy markets.

Renewable Energy Investment Growth

The renewable energy sector in Africa is experiencing a surge, driven by falling costs and shifting investor priorities. Solar PV has emerged as the most affordable power source in many African nations, reshaping how investors approach the market. This economic transformation has propelled private sector investments in clean energy to nearly $40 billion in 2024, marking a pivotal moment for the industry.

Investors are increasingly focusing on commercial and industrial solar projects and electric mobility, which carry lower payment risks compared to residential ventures. The electric vehicle (EV) sector has seen remarkable growth, with investments hitting nearly $70 million in 2023 – an eightfold increase since 2021. Large-scale initiatives, such as green hydrogen projects and EV battery production, are also drawing significant foreign investments. For instance, Morocco secured a $6.4 billion deal in 2023 to build an EV battery manufacturing facility. These developments underline Africa’s growing appeal to investors seeking opportunities in renewable energy.

However, challenges persist. Capital costs for utility-scale clean energy projects in Africa are 2–3 times higher than in advanced economies and China. This makes projects more expensive and financing more difficult. To meet its 2030 climate and energy targets, Africa requires $28 billion in concessional funding annually to unlock $90 billion in private investment. Blended finance, where development finance institutions help reduce project risks, has become critical. This approach is also paving the way for innovative tools like green bonds.

Green Bond Market Expansion

Green bonds are becoming a key instrument for financing Africa’s cleantech transition, though their use is evolving. Instead of funding entirely new projects, these bonds are often used to refinance existing “brownfield” projects, freeing up resources for new “greenfield” developments. This strategy, known as asset recycling, allows developers to reinvest in early-stage projects while maintaining momentum in the sector.

The building sector is a notable area of growth for green bonds, supporting energy efficiency projects through green mortgages and creative payment models like on-wage or on-bill plans. Impact platforms are also leveraging bond issuances to securitize loans, enabling local financial institutions to expand green lending. Governments are stepping in with sovereign green bond programs to set benchmarks and stimulate broader corporate bond markets. Given that energy efficiency projects currently receive less than 15% of concessional funding, the role of bond markets is becoming increasingly significant.

FDI Challenges and Capital Allocation

Despite the progress in financing models, Africa’s cleantech sector faces hurdles in attracting stable foreign direct investment (FDI). FDI in the sector fell by 3% to $53 billion in 2023, while international project finance deals dropped by 50% to $64 billion, following a 20% decline in 2022. Yet, there is a silver lining: Africa is securing a growing share of global greenfield megaprojects, particularly in green hydrogen and EV battery supply chains. In 2023, Mauritania announced a green hydrogen project with an estimated investment of $34 billion – an amount far exceeding the country’s annual GDP.

Despite representing 20% of the global population, Africa accounts for less than 2% of global clean energy spending. The financial instability of state-owned utilities, with system losses averaging 15% in 2020, creates high payment risks for private investors. Additional challenges, such as currency volatility and underdeveloped local financial systems, further complicate the investment landscape. Blended finance is becoming increasingly important as public and development funding has dropped by a third over the past decade, largely due to an 85% reduction in Chinese development finance.

“Emissions reductions provide a powerful reason to invest, but are often not the primary driver for investment in technologies that are increasingly mature and cost-competitive.” – IEA, World Energy Investment 2025

To overcome these barriers, targeted strategies are essential. Credit enhancements, local currency guarantees, and liquidity support mechanisms – such as those trialed in Gabon – are proving effective in improving project bankability. Strengthening regulatory frameworks and developing domestic capital markets will also be crucial to mitigating currency risks and external economic shocks.

Solar and Hydroelectric Power Projects

Africa is undergoing a significant shift in its renewable energy landscape, driven by ambitious hydroelectric and solar projects aimed at addressing chronic power shortages. One standout initiative is the Mphanda Nkuwa Hydroelectric Plant in Mozambique, the largest hydroelectric project in southern Africa in five decades. Backed by $6 billion in funding from the World Bank and developed by TotalEnergies, Électricité de France, and Hidroeléctrica de Cahora Bassa, this 1,500-megawatt facility is set to begin operations in 2031. Located about 37 miles downstream from the Cahora Bassa dam, it promises to help close a regional energy gap of 10,000 megawatts.

In Ethiopia, the Grand Renaissance Dam is nearing completion after a $4 billion investment. Once operational, it will generate over 5,000 megawatts of power, effectively doubling the country’s electricity output. Meanwhile, Egypt is advancing its renewable energy goals with a combined portfolio of 2,400 megawatts of hydroelectric and 1,400 megawatts of solar capacity. Across the continent, ongoing construction of 15,600 megawatts of hydroelectric dams and 8,100 megawatts of solar parks is contributing to a total of 32,700 megawatts of clean energy capacity in development.

Efforts to expand grid access are also making headway. In 2024 alone, Mozambique’s Electricidade de Moçambique (EDM) connected 563,000 homes to the electricity grid, with plans to add another 600,000 homes in 2025. These initiatives have significantly increased Mozambique’s electricity access rate from 31% in 2018 to 60% in 2024.

“Mozambique has the resources, gas, hydro, solar, and it’s already the biggest supplier of excess power to southern Africa”

In areas where extending the grid is not feasible, off-grid solar solutions are bridging the gap. In Mozambique, for instance, off-grid solar now accounts for 10% of electricity access, particularly benefiting remote rural communities. These projects are not only providing immediate solutions but are also laying the groundwork for long-term transformation, especially as Africa focuses on securing the critical minerals needed for green technology.

Critical Minerals for Green Technology

Africa is a powerhouse for essential minerals used in green technologies, contributing 76% of the world’s manganese and 69% of its cobalt supply. However, less than 5% of these minerals are refined on the continent. This is beginning to change as African nations push for policies aimed at adding value to their resources.

In Zimbabwe, a $400 million lithium sulfate processing plant, developed by China-based Huayou Cobalt, began testing in September 2025. This marks a pivotal step in the country’s efforts to establish a domestic battery value chain. Zimbabwe has also banned the export of unprocessed lithium, signaling its commitment to retaining more value locally. The Arcadia Lithium Mine, for example, has shifted its focus to exporting processed lithium instead of raw ore. Zimbabwe’s Deputy Mines Minister, Polite Kambamura, reinforced this vision:

“If we continue exporting raw lithium we will go nowhere. We want to see lithium batteries being developed in the country” – Polite Kambamura

Morocco is also emerging as a key player in the electric vehicle battery market. In June 2025, the Sino-Moroccan joint venture COBCO began producing nickel-manganese-cobalt precursor cathode materials for EV batteries. Meanwhile, the Democratic Republic of Congo (DRC) is home to the Manono deposit, believed to be the world’s largest lithium reserve, with an estimated 6.6 million tonnes. Although ownership disputes between AVZ Minerals and Zijin Mining have delayed progress, this deposit remains central to Africa’s role in the global battery metal supply chain.

With lithium demand projected to grow sixfold between 2022 and 2035, increasing Africa’s capacity to process these minerals will be crucial in meeting global climate goals. These developments underscore the continent’s growing importance in the transition to a greener future.

How Africa Attracts Global Cleantech Investors

Blended Finance Models

Africa is leveraging blended finance to tackle the challenges of high-risk perception and commercial viability in its cleantech sector. This approach mixes concessional capital – such as grants, low-interest loans, and guarantees from development finance institutions (DFIs) – with private investment to make projects more appealing to investors. The need for this is clear: utility-scale clean energy projects in Africa face capital costs that are 2 to 3 times higher than in developed countries.

To meet its clean energy goals, Africa requires significant concessional funding every year to attract private investments on a larger scale. Blended finance structures include tools like credit enhancements, currency hedging products (e.g., “The Currency Exchange” or TCX), and liquidity support to mitigate risks such as payment defaults by state-owned utilities. Local currency financing is gaining traction as it shields projects from exchange rate fluctuations and external economic shocks.

This model allows DFIs to focus on early-stage markets or untested technologies, while private investors take the lead in established areas like solar and wind energy. By reducing risk, blended finance is paving the way for governments to implement policy reforms that further boost investor confidence.

Policy and Regulatory Frameworks

Alongside innovative financial models, policy reforms are playing a crucial role in attracting global cleantech investment. For instance, competitive auction rounds in South Africa and Egypt have successfully encouraged private-led solar PV projects while driving down technology costs. Similarly, net metering policies in countries like Nigeria, South Africa, and Kenya are fueling the Commercial and Industrial (C&I) solar sector. This sector is expected to grow at an impressive 39% compound annual growth rate, reaching a market value of $1.6 billion by 2027.

Governments are also introducing national green taxonomies to guide institutional investors and expand sustainable finance initiatives. Countries like The Gambia, Zimbabwe, and Togo are piloting asset recycling programs, which free up funds for new greenfield projects. Meanwhile, nations such as Kenya, Ghana, Senegal, and Rwanda are encouraging consumer investments in energy-efficient appliances and green buildings through on-wage and on-bill payment plans.

Recognizing their potential in hydrogen energy, Namibia and Mauritania are developing common standards for low-emissions hydrogen trade. This effort aims to support long-term supply projects. These policy frameworks address a stark reality: while Africa accounts for 20% of the global population, it attracts less than 3% of global energy investment. As the International Energy Agency highlights:

“African governments also need to create the right enabling environment, ensuring stable regulation and financially reliable utilities.”

Public-Private Partnerships

Public-private partnerships (PPPs) are becoming a cornerstone in mobilizing private capital, building on the foundation of blended finance and regulatory reforms. Policy changes are breaking state monopolies, enabling Independent Power Producers (IPPs) and private buyers to engage directly with the grid. South Africa’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) is a standout example, contributing about 17% of Africa’s total renewable energy capacity.

In 2024, the NOA Group platform, backed by African Infrastructure Investment Managers (AIIM), achieved financial close on 239 megawatts of wind capacity in South Africa. This included the 140-megawatt Ishwati wind farm, marking a significant milestone as the first major wind project where the buyer is a start-up trading company rather than a state utility. Additionally, South Africa’s state utility, Eskom, has procured around 343 megawatts of utility-scale batteries as part of a broader 500-megawatt Battery Energy Storage System (BESS) initiative to stabilize the grid.

Large-scale projects like Algeria’s Tafouk 1 Mega Solar Project, valued at $3.6 billion, aim to deliver 4 gigawatts of solar energy by 2025, showcasing how PPPs can position countries as regional leaders. Kenya has also emerged as a geothermal powerhouse, with nearly 1 gigawatt of installed capacity, making it the seventh-largest producer globally. This success stems from favorable regulations and effective use of natural resources. As Olusola Lawson, Co-Managing Director at AIIM, notes:

“Transmission is the backbone of the energy transition and scaling up renewable energy must go hand-in-hand with grid expansion.”

Africa’s Cleantech Sector Beyond 2025

Expanding Renewable Energy Capacity

Africa has set an ambitious goal: reaching 300 GW of renewable energy capacity by 2030. To achieve this, the continent will need to add 32.5 GW annually from its current baseline of 8 GW. Solar energy is expected to lead this charge, projected to make up 70% of Africa’s installed capacity by 2050 – a staggering 100-fold increase. Wind energy will also play a significant role, growing 35 times to account for 20% of the total capacity.

Hydropower is another cornerstone of Africa’s renewable energy plans. Across Ethiopia, Egypt, Angola, Nigeria, and Tanzania, 15,600 MW of hydropower projects are already under construction. By 2050, Africa’s hydropower capacity is expected to quadruple. Egypt, for example, launched a diverse energy portfolio in October 2024, which includes 2,400 MW of hydroelectric power, 1,400 MW of solar, 2,500 MW of wind, and 1,200 MW of nuclear energy.

East Africa is making waves in geothermal energy. In 2023, Kenya secured $3.2 billion to build two new geothermal plants, solidifying its status as a global leader in this sector. Meanwhile, green hydrogen is emerging as a major export opportunity. Morocco, Namibia, and Mauritania are positioning themselves as global suppliers, with Morocco’s $10.6 billion green hydrogen and ammonia project launched by Total Eren in November 2022. Production is expected to start by 2027. By 2050, Africa could export 40 megatons of hydrogen annually. However, achieving these milestones will require substantial upgrades to grid and transmission infrastructure to handle the increased capacity.

Large-Scale Infrastructure Projects

For Africa to meet its renewable energy goals, annual energy investments will need to jump from $90 billion to over $200 billion by 2030. Grid infrastructure, in particular, is a major challenge. Current investments of $10 billion annually must rise to nearly $50 billion to integrate renewables effectively. African grids currently suffer from line losses averaging 15% – double the global average.

Efforts are already underway to expand cross-border transmission networks and create regional power pools. In 2023, a 1,700-kilometer transmission line connecting Senegal, the Gambia, Guinea, and Guinea-Bissau was completed, enabling clean energy sharing. Another key project is the 500-kilometer Kenya–Tanzania Interconnector, designed to allow power-surplus nations to export electricity to their neighbors.

Morocco is also making strides. In April 2021, Vinci Energies signed a $324 million contract to construct 500 kilometers of high-voltage power lines and 1,000 kilometers of distribution networks to support renewable energy integration. Meanwhile, Nigeria is moving forward with a 4,800 MW nuclear plant, currently in the pre-construction phase. Overall, Africa’s clean power capacity is expected to increase by 278% as existing and planned projects come online.

Africa’s Economic Transformation Through Cleantech

Beyond energy production, Africa’s cleantech sector is poised to reshape its economy. Despite supplying 75% of the world’s manganese, 70% of cobalt, and 20% of copper, Africa captures less than 1% of the manufacturing value from these resources. By increasing domestic processing and manufacturing, the continent could boost the market value of its processed minerals by nearly 75%, reaching $120 billion by 2040.

The Democratic Republic of Congo is already leading the way, attracting $130.7 million in mineral exploration investment in 2024 – the highest in Africa. Additionally, Africa’s rich mineral deposits and growing renewable energy capacity make it an ideal location for producing “green” commodities. For instance, low-emissions iron, which is valued at more than four times the price of raw iron ore exports, is a promising opportunity.

Electric vehicle (EV) production is another area of growth. Africa’s EV manufacturing is expected to rise from nearly zero today to 4 million units annually by 2035, eventually reaching 5 million by 2050. Achieving these milestones will require significant investment – about $2.9 trillion in cumulative capital expenditure between 2022 and 2050. Encouragingly, clean energy investment has already tripled, growing from $17 billion in 2019 to nearly $40 billion in 2024.

As McKinsey emphasizes: “Africa has the fastest-growing population in the world… Meeting their needs with cost-efficient, sustainable energy sources will be vital to the continent’s socioeconomic development.”

These developments highlight Africa’s growing influence in the global green economy, as it continues to balance sustainable energy expansion with economic transformation.

FAQs

What challenges do investors face in Africa’s cleantech sector?

Investing in Africa’s cleantech sector presents a range of challenges that can make even the most promising opportunities feel daunting. One of the biggest hurdles is the lack of access to financing. While Africa is home to about 20% of the world’s population, it only attracts roughly 3% of global energy investments. Why? Many investors see the region as high-risk. Cleantech projects often demand significant upfront capital and take longer to yield returns compared to the typical venture capital timeline, which makes them less appealing to traditional investors.

Then there’s the issue of economic instability. Factors like currency devaluation, inflation, and financial volatility across various African markets can scare off investors. These economic shifts don’t just create uncertainty – they can also erode the value of funds already committed. On top of that, policy and market infrastructure gaps add another layer of complexity. High import duties on renewable energy components and inconsistent regulations across countries make it harder to scale clean technologies effectively.

Tackling these challenges will require a collaborative approach. Stronger partnerships between the public and private sectors, innovative financial tools like currency hedging, and thoughtful policy reforms could help lower costs and make projects more attractive to investors.

What role do green bonds play in financing Africa’s green economy?

Green bonds are playing a crucial role in financing Africa’s expanding green economy. In 2024, sustainable debt issuances, including green bonds from governments, utilities, and private developers, hit a record high of $13 billion. These funds are directed toward transformative projects such as large-scale solar and wind farms, off-grid renewable energy systems, clean transportation networks, and energy-efficiency improvements. They offer the long-term, low-cost capital essential for cleantech initiatives that require extended payback periods.

By following international green bond standards and combining public guarantees with private investment, African issuers are successfully appealing to global investors who focus on ESG-compliant assets. This growing financial support is vital for boosting renewable energy capacity, upgrading power grids, and advancing the continent’s sustainable development efforts.

Why are critical minerals important to Africa’s cleantech growth?

Africa’s cleantech sector is on the rise, and critical minerals are at the heart of this growth. These minerals power technologies like solar panels, wind turbines, batteries, and hydrogen fuel systems – tools essential for the global shift to renewable energy. With its vast reserves, Africa holds the potential to play a major role in the clean-energy supply chain worldwide.

But the real opportunity lies beyond just mining these resources. By investing in refining processes, material production, and manufacturing, Africa can capture a larger share of the economic benefits tied to renewable energy technologies. This approach not only strengthens global supply chains but also attracts investments that prioritize environmental and social responsibility. The result? Industrial growth and a more resilient economy.

Critical minerals aren’t just raw materials – they’re a foundation for Africa’s green transition and its growing influence in shaping the future of sustainable energy.

This article was originally published on: Africa-Press

Share This:

- GroConsult

- No Comments

Togo Visa: If you’re planning a trip to Togo, you’ll most likely need to secure a visa before traveling. The good news is that Togo grants visas on arrival to nationals of most countries, with the exception of travelers from visa-exempt nations. This article breaks down Togo’s visa requirements—covering who needs a visa, the application process, required documentation, and answers to frequently asked questions.

Who Is Required to Obtain a Visa for Togo?

Almost all travelers planning to visit Togo are required to obtain a visa prior to entry. The only exceptions are citizens of the following countries, who are visa-exempt:

Benin

Burkina Faso

Cabo Verde

Côte d’Ivoire

Gambia

Ghana

Guinea

Guinea-Bissau

Liberia

Mali

Niger

Nigeria

Romania

Senegal

Sierra Leone

South Africa

In addition, holders of diplomatic or service passports from China and Morocco are also exempt from Togo’s visa requirements. Nationals of all other countries not listed above must obtain a valid Togo visa before they will be permitted to enter the country.

What Types of Visas Are Available for Travel to Togo?

The main types of visas issued by the Togolese government are:

Togo Immigration Visa, for foreigners intending to settle in Togo long-term

Togo Tourist Visa, issued for single and multiple entries, and for up to 90 days. You can apply for a Togo Tourist Visa if you are traveling for tourism, visit, or other non-business related purposes.

Togo Business Visa, issued to foreigners traveling to Togo for business-related purposes of up to 90 days. It can be single- or multiple-entry.

Togo Transit Visa, issued to foreigners transiting through the territory of Togo. The transit visa for Togo can be for a single or double-entry (roundtrip).

What Documents Are Required to Apply for a Togo Visa?

When applying for a Togo visa, you will be required to submit several supporting documents. These typically include:

- A valid passport, with at least six months’ validity beyond your intended stay and a minimum of two blank pages.

- Photocopies of the first two pages of your passport.

- A completed Togo visa application form.

- Two recent passport-sized photographs that meet the following criteria:

- Size: 4.5 × 3.5 cm

- White background

- Neutral facial expression

- Full visibility of the face and head (head coverings are permitted only for religious reasons, provided the face is not obscured)

- Proof of a return or onward flight booking.

- Valid travel insurance covering the entire duration of your stay, or evidence of payment of a repatriation deposit.

- Yellow Fever vaccination certificate or vaccination booklet.

Additional documents may be required depending on the type of visa you are applying for:

For a Togo Tourist Visa:

- Proof of accommodation in Togo, such as a confirmed hotel reservation.

For a Togo Business Visa:

- A letter of invitation from the host company in Togo or documents detailing the business assignment.

For a Togo Transit Visa:

- Proof of onward travel;

- A valid visa for your final destination, if applicable.

For a Togo Immigration Visa:

- Proof of income, such as recent bank statements;

- A motivation letter;

- Proof of health insurance coverage.

If the applicant is under 18 years of age, a parental consent form signed by both parents is also required.

What Is the Process for Applying for a Togo Visa?

Foreign nationals who require a visa to enter Togo can apply through one of two available options:

- Visa on Arrival, which can be obtained directly at an approved port of entry in Togo; or

- Embassy or Consulate Application, by submitting a visa request in advance at a Togolese Embassy or Consulate in your country of residence or in a neighboring country.

Each of these Togo visa application methods has its own procedures and requirements, which are explained in detail below.

Applying for a Togo Visa Upon Arrival

Nationals of all countries are eligible for a Togo Visa On Arrival. However, the Togo Visa On Arrival is only valid for seven days, with the possibility to extend it for up to 90 days once you’re already in Togo. You can get a Togo Visa On Arrival at the visa-issuing counters at the international airport in Lome or any of the major border crossings.

You need to have a Togo visa application form and two passport-size pictures with you and pay a fee [Contact for quote]. You may also have to show proof of Yellow Fever vaccination, accommodation, and a return flight ticket, as well as any other documents depending on the purpose of your travel.

If you want to stay for longer than 7 days, you can apply to extend your visa at the Foreigners and Passport Service in Toga before your current visa expires. The Togo visa extension is free of charge. However, many travelers who know they want to stay in Togo for longer than 7 days opt for applying for the visa before they travel at a Togolese Embassy or Consulate because they consider it to be less of a hassle than applying for an extension.

Applying for a Togo Visa Prior to Travel

If you want to stay in Togo for longer than 7 days, you can apply for a visa from a Togolese embassy or consulate before you travel. The exact Togo visa application process changes depending on the specific embassy/consulate in which you apply, but can be summed up as follows:

- Contact the embassy/consulate or, if possible, visit their website to learn about their opening hours, working days, and any specific requirements.

- Complete the Togo visa application form

- Gather the required documents (see the documents below)

- Pay the Togo visa fee*

- Submit the documents and application at the embassy or consulate. Some diplomatic offices allow applicants to submit their visa applications through the mail, especially if they live far away.

- Wait for the visa application to be processed. If the application is approved you will either have to go pick up your passport in person or have it mailed back to you, depending on the way through which you applied.

*The method of paying for the visa fee changes from one consulate to the other. You may have to pay in cash at the time of application or through a bank transfer beforehand.

How to complete the Togo visa application form?

You can download the Togo visa application form from one of the websites of Togo’s diplomatic representations abroad. Some embassies or consulates require you to fill it out beforehand and have it with you when you submit the application. Depending on the format of the application form file, you may be able to complete it electronically then just print it and sign it. Or, you may have to print it first and fill it out by hand. The Togo visa application form includes questions that clarify the purpose of your travel to Togo. You may also be able to pick up the visa application form at the embassy or consulate itself.

How Long Does it Take to Process a Togo Visa?

The processing time for a Togo visa depends on the specific Embassy or Consulate, but you can expect to wait at least between 5 – 10 working days starting from the time they receive your completed application. It may take longer, however, depending on the specific circumstances so you should start the application process at least about a month in advance, especially if you’re going to apply by mail.

How Long is a Togo Visa Valid For?

The duration of your Togo visa depends on the manner through which you apply. As such:

- A Togo Visa On Arrival is valid for only up to 7 days and can be extended for an additional 30 days while in Togo

- A Togo visa obtained from an embassy/consulate is issued for a maximum of 90 days, for single or multiple entries

Can I Extend a Togo Visa?

Yes, you can extend a Togo Visa On Arrival before it expires at the Togo Foreigners and Passport Service offices in Lome. If you want to extend a 30-day or 90-day visa, then you can apply for an extension at the Directorate General of National Documentation of the Togo Ministry of the Interior.

Share This:

- GroConsult

- No Comments

In today’s increasingly interconnected global economy, businesses are no longer restricted by geographical borders when sourcing talent. Digital transformation, remote work adoption, and global expansion strategies have fundamentally reshaped how organizations build and manage their workforce. Companies can now hire a software engineer in Kenya, a finance analyst in Nigeria, a project manager in Ghana, or a customer support specialist in Rwanda—all without opening physical offices.

However, while global hiring unlocks access to world-class talent, it also introduces complex legal, tax, payroll, immigration, and compliance challenges. Each country has its own labor laws, tax frameworks, social security systems, and employment regulations. Navigating these independently can be expensive, risky, and time-consuming.

This is where Employer of Record (EOR) services play a transformative role.

At the forefront of this transformation in Africa and emerging markets is GroConsult, a trusted Employer of Record and workforce solutions partner helping companies expand seamlessly, compliantly, and cost-effectively across borders.

This article explores Employer of Record (EOR) services across industries and sectors, with a strong focus on Africa, and explains how GroConsult enables organizations to hire, manage, and scale global teams with confidence.

What Is an Employer of Record (EOR)?

An Employer of Record (EOR) is a third-party organization that legally employs workers on behalf of another company. While the client company manages the employee’s day-to-day responsibilities, performance, and deliverables, the EOR assumes responsibility for all legal and administrative employment obligations.

These responsibilities typically include:

- Employment contracts compliant with local labor laws

- Payroll processing and salary disbursement

- Income tax, social security, and statutory deductions

- Benefits administration

- Employment compliance and labor law adherence

- Termination management and severance compliance

- Immigration and work permit support (where applicable)

With an EOR, companies can legally hire employees in foreign countries without establishing a local legal entity, significantly reducing cost, risk, and time to market.

Why Employer of Record Services Are Critical for Africa-Focused Expansion

Africa is one of the fastest-growing talent markets in the world. With a young population, expanding digital skills base, and increasing foreign investment, the continent presents immense opportunities for global companies.

However, Africa is not a single market—it consists of 54 countries, each with unique employment laws, tax regimes, currency regulations, and immigration frameworks. This diversity makes EOR services not just helpful, but essential.

GroConsult’s Employer of Record services are designed specifically to address the complexities of African markets while maintaining global standards of compliance, transparency, and operational excellence.

Key Industries Leveraging Employer of Record Services

1. Technology and IT

The technology sector is one of the largest adopters of Employer of Record services globally. Companies increasingly rely on distributed teams for software development, cybersecurity, data analytics, AI, product design, and IT support.

Across Africa, countries like Ghana, Nigeria, Kenya, Egypt, Rwanda, and South Africa have emerged as major tech talent hubs.

How GroConsult supports tech companies:

- Rapid onboarding of developers and engineers

- Local employment contracts compliant with labor laws

- Multi-currency payroll management

- Equity, allowances, and benefits structuring

- Contractor-to-employee conversion

For startups and scale-ups, GroConsult enables fast market entry without the legal burden of setting up subsidiaries.

2. Healthcare and Pharmaceuticals

Healthcare organizations require highly specialized professionals—doctors, nurses, laboratory technicians, researchers, and regulatory experts. Compliance is especially critical due to licensing requirements, healthcare regulations, and immigration controls.

GroConsult’s EOR solutions for healthcare include:

- Work permits and residence permits for expatriate professionals

- Compliance with healthcare labor regulations

- Payroll and statutory contributions

- Dependent permits and relocation support

- Confidential handling of sensitive employment data

This allows healthcare providers and NGOs to focus on patient care and public health outcomes rather than administrative complexity.

3. Manufacturing and Industrial Operations

Manufacturers expanding into Africa often face challenges related to labor unions, minimum wage laws, overtime regulations, and occupational safety compliance.

Employer of Record services help manufacturers hire local teams for:

- Factory operations

- Supply chain and logistics

- Quality control

- Engineering and maintenance

- Regional sales and distribution

GroConsult ensures that manufacturing companies remain compliant with local labor standards while maintaining operational efficiency and workforce stability.

4. Education, EdTech, and e-Learning

The rise of online education and remote learning has enabled institutions to recruit educators, trainers, curriculum developers, and academic administrators from across the globe.

With GroConsult as an EOR, education providers can:

- Hire educators across multiple African countries

- Ensure correct tax treatment and statutory deductions

- Pay educators in local currencies

- Comply with employment classification rules

- Offer competitive local benefits

This is especially valuable for international schools, online academies, and professional training organizations operating in Africa.

5. Non-Profit Organizations and Development Agencies

Non-profits, international NGOs, and development organizations often operate in multiple countries with limited administrative capacity. Compliance failures can lead to reputational damage and funding risks.

GroConsult supports non-profits by:

- Acting as the legal employer for local staff

- Managing payroll and compliance transparently

- Supporting donor audit requirements

- Providing immigration and mobility services

- Ensuring ethical and compliant employment practices

This enables organizations to focus on impact rather than administration.

Why Employer of Record Services Are Transformative

Simplified Global Hiring

Traditionally, hiring in a new country required:

- Registering a legal entity

- Opening bank accounts

- Hiring local accountants and lawyers

- Managing ongoing compliance

With GroConsult’s EOR services, companies can hire in days instead of months, accelerating growth and market entry.

Guaranteed Compliance Across Jurisdictions

Labor laws in Africa change frequently and vary widely across countries. GroConsult maintains in-country expertise to ensure full compliance with:

- Employment legislation

- Tax authorities

- Social security institutions

- Immigration departments

This significantly reduces legal and financial risk.

Cost-Effective Workforce Expansion

Setting up entities is expensive and often unjustified for small teams or pilot markets. EOR services eliminate:

- Entity setup costs

- Legal retainer fees

- Long-term fixed overheads

GroConsult offers a predictable, scalable cost model ideal for startups, SMEs, and multinational corporations alike.

Enhancing Business Flexibility Through EOR Services

Supporting Remote and Hybrid Work

Remote work is no longer optional—it is a strategic advantage. GroConsult enables companies to hire remote employees across Africa while maintaining full legal compliance.

Fast Market Entry and Exit

With an Employer of Record, companies can:

- Test new markets quickly

- Scale teams up or down as needed

- Exit markets without complex legal closures

This flexibility is critical in fast-changing economic environments.

Contractor and Workforce Classification Management

Misclassifying contractors as employees can lead to severe penalties. GroConsult helps businesses:

- Structure compliant contracts

- Convert contractors to employees

- Avoid permanent establishment risks

Challenges Addressed by Employer of Record Services

Navigating Complex Labor Laws

Each African country has unique employment rules around:

- Termination

- Severance

- Leave entitlements

- Union engagement

GroConsult acts as a trusted compliance partner, minimizing exposure to disputes.

Multi-Currency Payroll and Tax Management

Paying employees across borders involves currency risks, tax compliance, and banking challenges. GroConsult ensures:

- Timely salary payments

- Accurate tax deductions

- Statutory reporting compliance

Localized Benefits and Employee Experience

Competitive benefits differ across countries. GroConsult designs localized benefit packages that attract and retain top talent while remaining compliant.

The Role of Technology in Modern EOR Services

GroConsult leverages modern workforce technology to deliver efficient and transparent services, including:

- Global HRIS integration for employee data management

- Automated compliance monitoring

- Secure payroll systems

- Data protection aligned with global standards

Technology enhances accuracy, scalability, and employee experience.

Employer of Record Services in Emerging Markets

Emerging markets across Africa present immense opportunities—but also regulatory complexity. GroConsult provides:

- Local market intelligence

- Employment cost forecasting

- Cultural and regulatory guidance

- Risk mitigation strategies

This makes GroConsult a strategic partner, not just a service provider.

Choosing the Right Employer of Record Partner

When selecting an EOR, businesses should evaluate:

- Regional expertise, especially in Africa

- Proven compliance track record

- End-to-end service coverage (EOR, payroll, immigration, HR)

- Technology and reporting capabilities

- Dedicated human support

Why GroConsult Is a Leading Employer of Record Partner in Africa

GroConsult stands out as a trusted Employer of Record partner with deep expertise in Africa and emerging markets.

What Sets GroConsult Apart

- Strong presence across key African markets

- Comprehensive EOR, payroll, HR, tax, and immigration services

- Africa-first approach with global standards

- Dedicated account management and advisory support

- Proven experience supporting multinationals, startups, NGOs, and remote teams

GroConsult enables companies to hire talent across Africa without establishing legal entities, while ensuring full compliance, transparency, and efficiency.

Building the Future of Work with GroConsult

Employer of Record services are no longer a luxury—they are a strategic necessity for modern businesses expanding globally. Across technology, healthcare, manufacturing, education, and non-profit sectors, EOR solutions are reshaping how organizations build and manage distributed teams.

With its deep regional expertise, compliance-driven approach, and human-centered service model, GroConsult empowers businesses to scale confidently across Africa and beyond.

For organizations looking to expand into Africa, manage remote teams, or simplify global employment, GroConsult provides a smarter, compliant, and cost-effective pathway to building a truly global workforce.

Share This:

- GroConsult

- No Comments

Ghana stands at a decisive crossroads. After years of macroeconomic instability, escalating inflation, and weakened investor confidence, 2026 is being framed by policymakers as a year of strategic consolidation and disciplined economic reform rather than rapid expansion. At the heart of this shift is the Bank of Ghana (BoG), whose Governor, Dr. Johnson Pandit Asiama, has outlined a bold agenda that prioritises sustainability, institutional strength, monetary discipline, and long-term policy consistency.

This article explores why 2026 is a turning point for Ghana’s economic strategy, what the new focus entails, and how these reforms could reshape Ghana’s macroeconomic trajectory.

Why 2026 Matters: The End of Adjustment, Start of Consolidation

In public remarks at the Bank’s New Year media engagement in Accra, Dr. Johnson Asiama stressed that 2026 will be a transition year — moving from rapid, adjustment-driven policies towards durable frameworks anchored in institutional strength and fiscal discipline.

Rather than reacting to immediate pressures, the BoG’s 2026 strategy emphasises:

- Policy discipline instead of ad hoc interventions

- Strong, predictable monetary and financial systems

- Sustainable, long-term economic outcomes

- Quality over quantity in reforms

This marks a notable departure from earlier phases characterised by aggressive emergency measures to stabilise prices and secure balance-of-payments stability.

From Stability to Sustainable Growth: The New Economic Playbook

1. Entrenching Macroeconomic Stability

After a tumultuous period marked by high inflation and exchange-rate volatility, the Bank of Ghana has succeeded in restoring a degree of economic stability — a foundation that the BoG now aims to make permanent.

Monetary authorities are prioritising:

- Credible, predictable monetary policy

- Effective liquidity management

- Forward-looking policy signals to markets

This means moving beyond crisis management and embedding stability into the economy’s DNA, which is vital to investor confidence and long-term planning.

2. Discipline in Financial Markets and Banking

Ghana’s financial markets and banking sector are set to experience deeper systemic discipline. According to the BoG, priorities include:

- Preventive financial supervision

- Rigorous governance standards in banking

- Sound capital planning and risk detection before systemic problems emerge

These reforms are designed to ensure the financial sector supports sustainable growth without the need for turbulent interventions.

3. Anchoring Policies in Institutions, Not Individuals

A key theme of 2026’s economic strategy is institutionalisation — making policies resilient to leadership changes and political shifts. Dr. Asiama emphasised the need for a shift from personality-driven governance to rules-based, credible systems that ensure long-term stability regardless of political cycles.

Monetary Policy: Discipline, Rates, and Future Outlook

Interest Rate Reductions Reflect Confidence

Ghana’s central bank has presided over a significant easing of monetary policy, reducing the policy rate aggressively through 2025 and into 2026. This trajectory reflects sustained disinflation, improved fiscal discipline, and a return of macroeconomic confidence.

This easing cycle has helped stimulate investment and reduce borrowing costs, setting the stage for broader economic expansion.

Lending Rates Could Fall Below 10% by Year-End

In a clear signal of optimism, the BoG has projected that lending rates in Ghana could fall to around 10% by the end of 2026 — a dramatic turnaround from the double-digit costs of capital that historically stunted business growth and entrepreneurship.

Lower lending rates mean:

- More affordable business loans

- Greater access to capital for SMEs

- Boosted investment and job creation

This is a central plank in the strategy to transform raw economic stability into inclusive economic growth.

Cedi Stability: A Balanced Approach

The Ghanaian cedi’s behaviour in recent years has reflected broader structural challenges. While the currency has shown moments of strengthening, the BoG has emphasised that exchange-rate stability must be balanced and consistent with macroeconomic fundamentals — not artificial or overly anchored.

This nuanced approach is important for maintaining export competitiveness and avoiding distortions that could undermine growth.

Ongoing Reforms: From Gold Reserves to Media Engagement

Revising Strategic Programmes like Gold-for-Reserves

One area of ongoing attention is Ghana’s Gold-for-Reserves programme — a scheme designed to bolster reserves in past years. The BoG Governor has urged Parliament and stakeholders to work collaboratively on reforming this initiative, making it more efficient and effective in supporting economic stabilisation.

Strengthening Media Partnerships for Better Economic Awareness

An often-overlooked pillar of Ghana’s economic strategy involves improving how economic news and policy information are communicated. The BoG plans to deepen engagement with journalists and create training programmes aimed at elevating the quality of economic reporting.

This is vital in a digital age where accurate information can shape investor sentiment and public understanding.

The Broader Economic Context: IMF Support and Sector Priorities

Ghana’s economic strategies are not formulated in a vacuum. IMF support has been crucial in backing fiscal consolidation and structural reforms that put the economy on a more stable footing. Progress in meeting benchmarks has led to positive assessments from international partners.

Meanwhile, the government’s broader 2026 economic plan highlights priority sectors such as:

- Agribusiness and agro-processing

- Industrialisation and manufacturing

- Infrastructure and energy expansion

These initiatives are expected to diversify the economy and support value addition across key segments.

What This Means for Ghana’s Future

The BoG’s message is clear: 2026 is not just another year — it’s a turning point. Rather than focusing on short-term fixes, Ghana’s economic strategy is oriented toward building deep, resilient foundations that can withstand global shocks, support investment, and unlock sustainable growth.

Across monetary policy, financial sector reform, institutional strengthening, and communication strategies, the emphasis is on delivering long-lasting dividends for businesses, investors, and ordinary citizens alike.

As the year unfolds, the success of this strategy will hinge on disciplined implementation, continued policy coherence, and strong collaboration between government agencies, the private sector, and international partners.

Share This:

- GroConsult

- No Comments

Ghana has reinforced its status as a strategic manufacturing and export hub for Japanese businesses seeking access to West Africa and the wider African Continental Free Trade Area (AfCFTA) market, as the Ghana-Japan Business Forum opened in Accra.

Deputy Minister for Trade, Agribusiness, and Industry, Sampson Ahi, said government is deliberately shifting its engagement with Japan away from raw material exports toward value-added manufacturing, logistics, and integrated industrial value chains that can serve both domestic and continental markets.

Speaking at the forum on Thursday, January 15, 2026, at the Ghana EXIM Bank, Mr. Ahi encouraged Japanese companies to leverage Ghana’s stable investment climate, expanding industrial parks, and Special Economic Zones to establish production bases capable of serving the AfCFTA market.

He reiterated Ghana’s ambition to become a gateway for export-oriented manufacturing into Africa, highlighting the country’s © political stability, entrepreneurial culture, and young, trainable workforce as strong incentives for long-term industrial investment.

“When Ghana’s stability and workforce are combined with Japan’s discipline, quality, and innovation, the outcome is not trade in raw materials but value addition, jobs, and globally competitive businesses,” he said.

Mr. Ahi outlined key priority areas for Ghana-Japan cooperation, including industrial platforms and export-oriented manufacturing, manufacturing value chains and industrial inputs, as well as logistics, trade facilitation, and standards. These sectors, he noted, present immediate opportunities for joint ventures that can create jobs and deepen skills transfer for Ghanaians.

Japan’s Ambassador to Ghana, H.E. Hiroshi Yoshimoto, described Ghana as a reliable partner for Japanese investors, citing the country’s consistent economic reforms and strong democratic governance. He reaffirmed Japan’s commitment to supporting technology transfer, infrastructure development, and industrial capacity building.

Japan’s Minister for Foreign Affairs, Dr. Kunimistu Ayano, also underscored the importance of robust public-private collaboration in translating diplomatic relations into tangible economic outcomes, noting Japan’s interest in supporting industrial development, sustainable energy, and logistics infrastructure in Ghana.

Chief Executive Officer of the Ghana Investment Promotion Centre (GIPC), Simon Madjie, assured investors of Ghana’s business-friendly regulatory environment and strong aftercare services. He added that government initiatives, including the 24-hour economy policy framework, further enhance Ghana’s competitiveness as an investment destination in the sub-region.

In a statement delivered on his behalf, the Secretary-General of the AfCFTA Secretariat encouraged Japanese businesses to view Ghana as a launchpad into the African market, noting that companies operating from Ghana can access a single market of more than 1.3 billion people under the AfCFTA.

The forum featured extensive business-to-business engagements, with discussions centred on sustainable agribusiness, manufacturing, energy solutions, transportation infrastructure, and digital communications. Several Japanese firms expressed interest in partnerships and joint ventures, signalling a growing pipeline of investments that could accelerate Ghana’s industrialisation agenda and deepen economic ties between the two countries.

This article was originally published on: CitiNewsRoom

Share This:

- GroConsult

- No Comments

The UK-Ghana Chamber of Commerce (UKGCC) has released the seventh edition of its annual Business Environment and Competitiveness Survey (BECS) Report for the year 2025.

This year’s survey recorded a significant rise in participation, with 1,016 businesses responding — a 40% increase over 2024’s 725 participants. Respondents were drawn from 22 industries, including wholesale and retail trade, other services, accommodation and food services, healthcare, education, construction, transport, professional services, agriculture, and multiple branches of manufacturing such as food and beverages, textiles, machinery, chemicals, electronics and metals.

Overall sentiments expressed by businesses indicate a cautiously positive outlook. Many respondents observed that Ghana’s economic climate is stabilising, aided by lower inflation, a more stable currency, and declining interest rates. Businesses also acknowledged improvements in infrastructure, management skills, telecommunications and political stability.

As a result, the proportion of companies who perceive Ghana’s business environment as trailing behind regional competitors fell from 69% last year to 58%.

Key Survey Findings

The survey’s findings point to several encouraging developments. For instance, respondents noted improved access to quality infrastructure and lower telecommunication costs, reflecting ongoing investment and reforms in these areas. Businesses also reported stronger management capability across organisations, increasing adoption of advanced technology, and greater confidence in the stability and effectiveness of the political system following the 2024 general elections.

These positive changes are contributing to more predictable operating conditions and gradually improving competitiveness.